How to Automate TradingView Alerts into Interactive Brokers Orders

Automating TradingView alerts to execute trades in Interactive Brokers (IB) can significantly boost your trading efficiency. This guide will show you how to achieve this integration step-by-step, optimizing your algo trading setup.

Introduction to Algo Trading with TradingView and Interactive Brokers

The Power of Algo Trading

Algo trading uses computer algorithms to automatically execute trades at optimal times. This reduces human errors and emotions, improving efficiency and profitability. By integrating TradingView’s advanced charting tools with Interactive Brokers’ robust trading platform, you can automate and streamline your trading process.

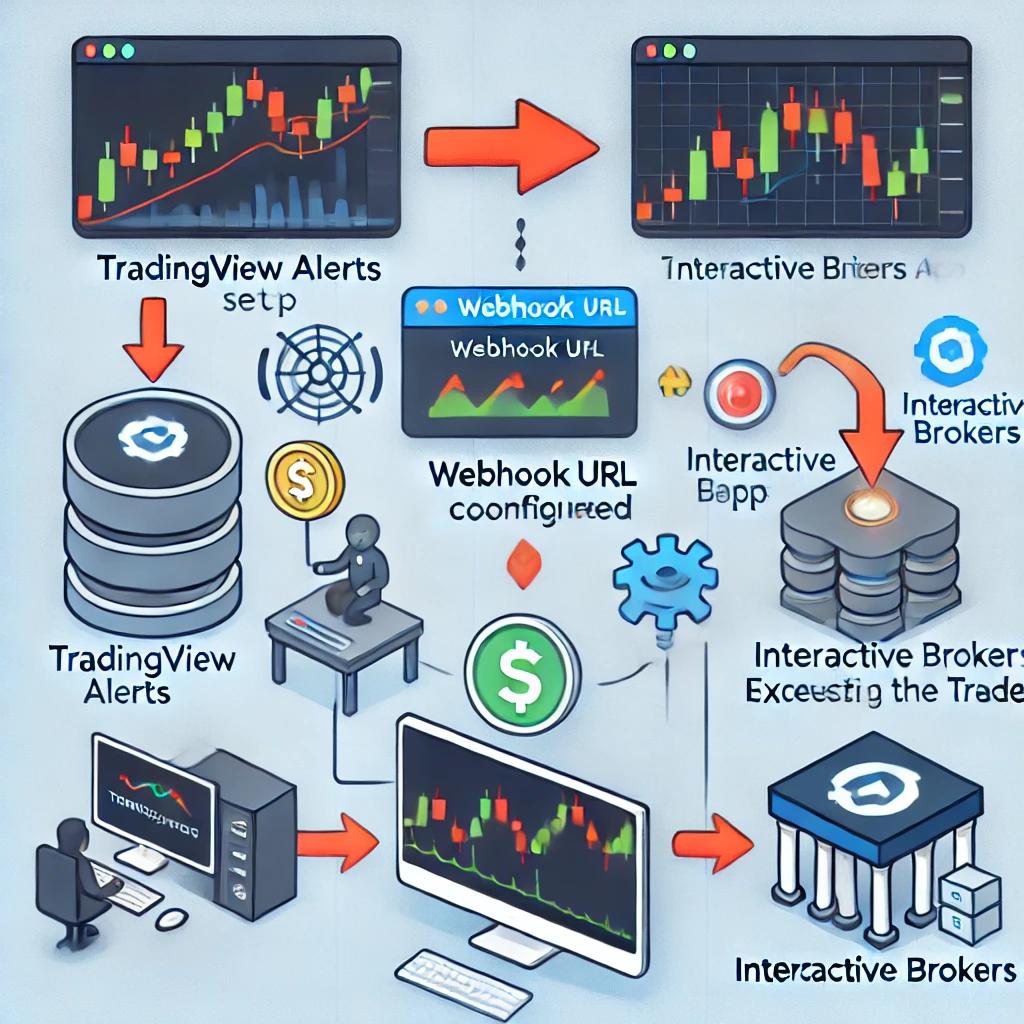

Overview of TradingView and Interactive Brokers Integration

TradingView provides powerful charting tools and real-time market data, making it a favorite among traders. Interactive Brokers offers access to various financial instruments with low-cost, high-speed trade execution. Integrating these platforms allows you to automate trades based on conditions set in TradingView, creating a seamless trading experience.

Benefits of Automation

Automation leads to faster trade execution and fewer errors. It lets you execute complex strategies effortlessly and frees up time to focus on market analysis and strategy development. For algo traders, this means more precision and better trading results.

Setting Up TradingView Alerts and Webhooks for Automated Trading

Customizing Alerts for Algo Trading

To tailor alerts to your algo trading strategy, use TradingView’s extensive customization options. Set alerts for various conditions, from simple price thresholds to complex indicator combinations. Regularly review and adjust your alerts based on market conditions and your trading performance.

Common Pitfalls and How to Avoid Them

Avoid overly broad conditions to prevent false positives and ensure alerts align with your trading strategy. Test alerts in a demo environment before going live and periodically review them to maintain accuracy.

Examples of Effective Alerts

For example, a simple yet effective alert might be setting an alert for a moving average crossover. This alert notifies you when the short-term moving average crosses above or below the long-term moving average, signaling potential buy or sell opportunities. Another useful alert could be based on the Relative Strength Index (RSI), notifying you when the asset is overbought or oversold.

Setting Up Webhooks in TradingView

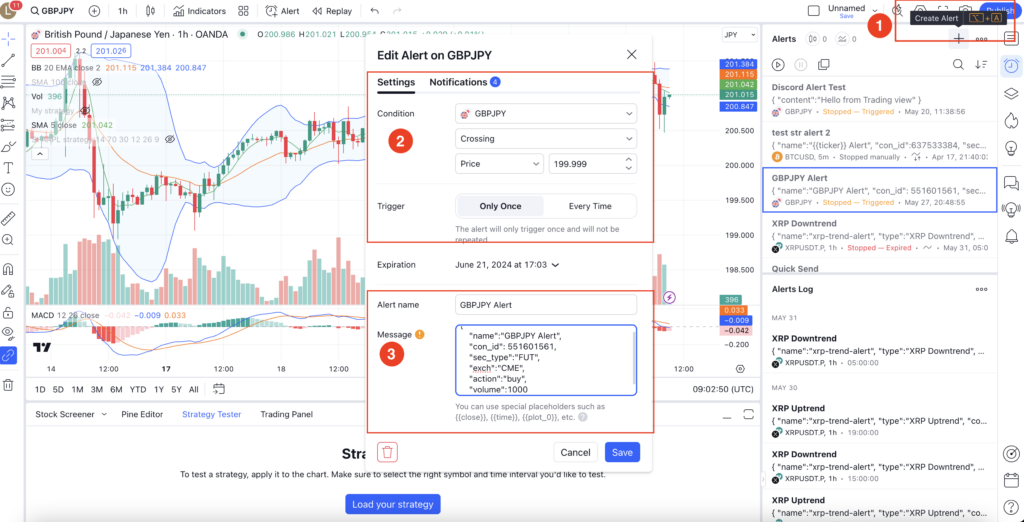

To automate trades, you need to configure webhooks in TradingView. Here’s how:

Step 1: Create the Alert: Click on ‘+’ on the top right corner

Step 2: Setup Alert Rule: Set up an alert condition your desired conditions.

Step 3: Customize Message: In the ‘Message’ field, format the message to include necessary details like the symbol, price, and action (buy/sell). (The message format depends on third party app that process the alert)

{

"name": "GPBJPY Alert",

"con_id": 61664943,

"sec_type": "CASH",

"exch": "SMART",

"action": "sell",

"volume": 20000

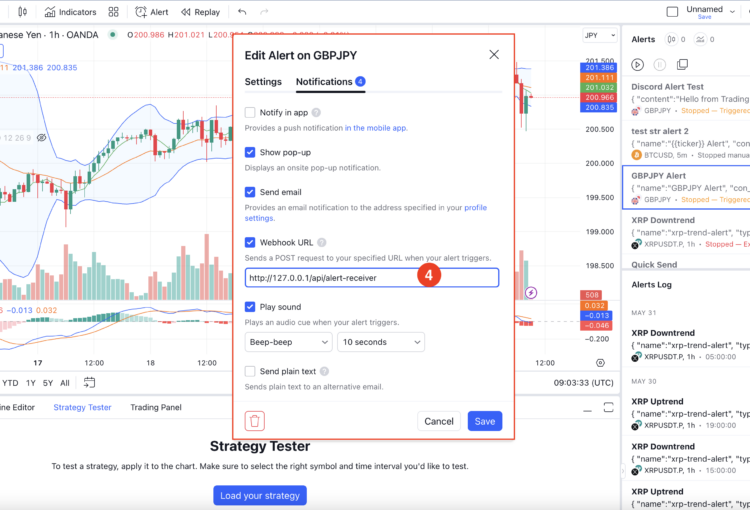

}Step4 : Enter Webhook URL: Enter the URL of your server or third-party service that will process the alert. This URL should point to a service that can receive the alert and execute trades in Interactive Brokers.

Advantages of Using Webhooks

Webhooks provide real-time automation, ensuring that trades are executed as soon as alert conditions are met. They also offer flexibility and can be customized to execute various types of orders. Using a tool like Xerolite can simplify the integration process and enhance the reliability of your webhook setup.

Real-World Examples

A trader using a momentum-based strategy can set up webhooks to execute trades instantly when the conditions are met. This ensures timely execution and reduces the risk of missing out on market opportunities. Xerolite can further optimize this process by providing additional customization options and security features.

Integrating Interactive Brokers with Third-Party Apps

Introduction to Interactive Brokers and TWS API

Interactive Brokers (IB) is renowned for its low-cost, high-speed trade execution and access to a vast array of financial instruments. The Trader Workstation (TWS) API allows for sophisticated automation of trading strategies. However, there are several limitations to be aware of:

- TWS Setup Required: Integration with Interactive Brokers requires setting up their Trader Workstation (TWS), which is essential for the API to function correctly.

- Complex API: The TWS API is more complex compared to the simpler REST APIs offered by other brokers, which can increase the time and effort required for setup and troubleshooting.

- Local Setup: The TWS API must be installed and run on the same machine as TWS, which can limit flexibility in deployment.

- Persistent Connection: Maintaining a stable and persistent connection to TWS is crucial for reliable trade execution. Any interruptions can result in missed trades or execution errors.

- Regular Maintenance: Both TWS and the third-party app may require regular updates and maintenance to ensure compatibility and optimal performance.

Despite these limitations, the TWS API offers powerful features for algo traders who can navigate its complexity.

The Role of Third-Party Apps

To fully automate the process, you need a third-party application that integrates with Interactive Brokers’ TWS API. This app will act as an API listener to process alerts configured in the TradingView webhook URL and convert them into orders placed into IB via TWS. Here’s what to look for in a third-party app:

- Server Deployment with Public IP: The app should be deployable on a server with a public IP address to ensure accessibility.

- API to Listen to TradingView Alerts: The app must have an API to listen to TradingView alerts, configured via the webhook URL.

- Whitelisting for Security: The app should support whitelisting to ensure only TradingView can access it.

- Integration with TWS: The app must support integration with Interactive Brokers’ TWS.

- Convert Alerts to IB Orders: The app should be able to convert the alerts received into orders and place them into IB via TWS.

Setting Up the Third-Party App

- Choose Your App: Select a third-party app that supports integration with TWS API, such as Xerolite.

- Install the App: Follow the installation instructions provided by the app.

- Configure the API Listener: Set up the app to listen for incoming webhooks from TradingView.

- Link to TWS: Ensure the app is properly linked to your IB account via the TWS API. This might require entering your API key and other account details.

- Test the Setup: Before going live, test the entire setup with demo trades to ensure everything is working correctly.

Enhancing Your Setup with Xerolite

Benefits of Using Xerolite

Xerolite is designed to bridge TradingView alerts and Interactive Brokers seamlessly. It simplifies the integration process, making it accessible even for those with limited technical knowledge. It ensures quick and accurate trade execution, provides real-time monitoring, and offers advanced security features. Here are some key benefits:

- Lightweight: Xerolite is a lightweight program that doesn’t require extensive system resources.

- Secure with Whitelisting: Xerolite enhances security through its whitelisting feature, ensuring only pre-approved trades are executed.

- User-Friendly Interface: The interface is easy to use, providing features like alert logs and transaction status to keep you informed.

Case Studies and Success Stories

Many algo traders have successfully automated their trading strategies using Xerolite. For instance, one trader used Xerolite to automate a momentum-based strategy, resulting in improved profitability and reduced manual intervention. Another trader used Xerolite to manage multiple trading accounts, streamlining their operations and achieving consistent trading results.

Conclusion

Automating TradingView alerts to execute trades in Interactive Brokers using tools like Xerolite can significantly enhance your algo trading efficiency. By following the steps outlined and leveraging webhooks and customization options, you can create a robust and automated trading system that operates seamlessly. Whether you’re looking to optimize trade execution speed, minimize errors, or implement complex strategies with precision, integrating TradingView and Interactive Brokers is a game-changer for algo traders.

Get Started Today: Set up your TradingView alerts, configure webhooks, and explore the benefits of Xerolite. Embrace automation and take your trading to the next level.

Stay Updated: The world of algo trading is ever-evolving. Stay informed about the latest tools, strategies, and market trends to continuously improve your trading setup.

Join the Community: Engage with other traders in the TradingView community to share insights, strategies, and experiences. Learning from others can provide new perspectives and ideas for your trading approach.

Final Thoughts: Automation is the future of trading. By integrating powerful tools like TradingView and Interactive Brokers, and utilizing advanced features offered by Xerolite, you can achieve greater control, efficiency, and success in your trading endeavors. Happy trading!

For more detailed instructions and support, refer to the TradingView help center and Interactive Brokers documentation. They provide comprehensive guides on setting up and managing automated trades between TradingView and Interactive Brokers.

Automate your trading process and enjoy the benefits of a streamlined, efficient, and highly effective trading system.